Click below to listen to Episode 115 – Roller Coasters, Emotions, And Rubber Bands

Subscribe: Apple Podcasts | Google Podcasts | Spotify | Amazon Music | Stitcher | RSS | More

Roller Coasters, Emotions, And Rubber Bands

Learn how to get a better handle on your roller coaster of emotions when it comes to the stock market.

The stock markets can make even the best of us get emotional. It goes up; we may become happy and excited! It goes down; we might become worried and stressed. So, how can we combat this roller coaster of emotions in order to get a better handle on how we feel when it comes to the continual ups and downs of the stock market?

One way is by getting educated on typical market trends and understanding just exactly how bear and bull markets work. In this episode, Bob and Shawn present some tips, and of course Bible verses, on getting a better perspective on the market, its checks and balances, and just taking your emotions out of the investment game, or at least as much as possible, anyways!

HOSTED BY: Bob Barber, CWS®, CKA®

CO-HOST: Shawn Peters

Mentioned In This Episode

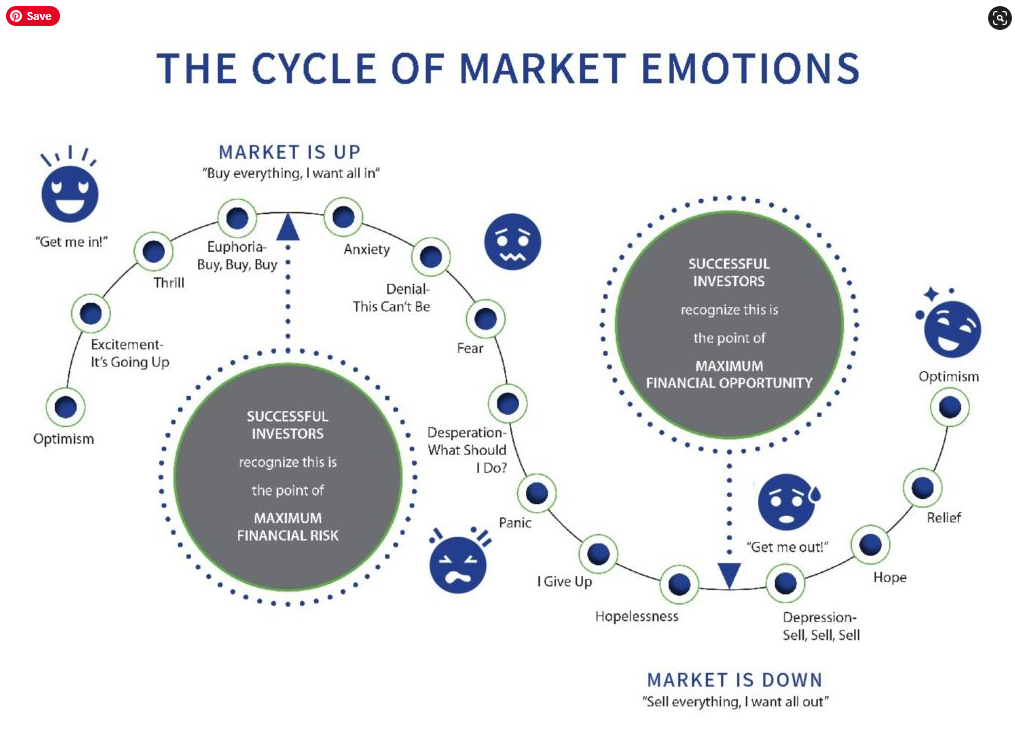

The “Cycle Of Market Emotions” Chart

Want to ask a question about your specific situation? Schedule a complimentary 15 minute phone call.

EPISODE TRANSCRIPT

[INTRODUCTION]

Welcome to “Christian Financial Perspectives”, where you’re invited to gain insight, wisdom and knowledge about how Christians integrate their faith, life and finances with a Biblical Worldview. Here’s your host Christian Investment Advisor, Financial Planner, and Coach, Bob Barber.

[EPISODE]

Shawn:

Matthew 6:27; 32-34 NIV; 27, “Can any one of you by worrying at a single hour to your life?” 32 through 34, “For the pagans run after all these things and your heavenly father knows that you need them, but seek first his kingdom and his righteousness and all these things will be given to you as well. Therefore, do not worry about tomorrow for tomorrow will worry about itself. Each day has enough trouble of its own.”

Bob:

Amen. Amen. Love that scripture. That scripture helps get me through these crazy times like we’re in right now.

Shawn:

Yeah.

Bob:

Especially with what you and I do for a living. It is a rollercoaster. I heard you tell me a couple weeks ago, you said, “Bob, would it make any sense for you to ever jump off a roller coaster while it’s in motion?” And the answer is, “Of course not.”

Shawn:

Definitely not. Especially not if the roller coaster is not just in motion, but it’s currently going down one of the hills.

Bob:

A little steep one like this.

Shawn:

Not a good idea. Exactly. And then about to go through a loop du loop.

Bob:

Then it’s gonna come back up. So it’s gonna go down, but then it’s gonna come back up. So that’s what we’re experiencing in the markets right now. I mean, I was just looking at the markets today. I cannot believe the volatility. That’s a rollercoaster, and how it can play with your emotions and how you and I are gonna use this example later – a rubber band.

Shawn:

Yep.

Bob:

okay. So today’s subject is rollercoasters, emotions, and rubber bands.

Bob:

So, I’m gonna have Garrett put a chart up there for you. He’s gonna put a chart, and I want y’all to take a look at this, and we’re gonna go over it right here. I’ve got to find where the chart is. There it is. And this is what we call our cycles of emotions, market emotions. This has been a chart, Shawn, we’ve been using for years and years. I mean, you’ve been with me. You started with me in ’08.

Shawn:

Yep.

Bob:

And I remember we were using this chart.

Shawn:

It’s still true.

Bob:

Your wife, my daughter, has really helped put all the little faces in it. Get me out. And you’ve got the sad face and then you have the panic face. And what’s interesting is this chart can help you a lot with investing because this is the crazy ups and downs that we’re going through right now. Back in October when we took a lot off the table, everybody was like, why are you doing that? At that point, you can see what the chart says. It’s got…

Shawn:

Euphoria. Buy. Buy. Buy.

Bob:

That’s a Southern boy. I can’t say these words. Of course, you’re from South Carolina.

Shawn:

It’s okay, Bob, I graduated with degree in business finance, so I can do the fancy words sometimes.

Bob:

but at that point was the maximum financial risk and it’s. You can look at this and see the real estate markets a couple months ago was the same way. I mean, back in January, February, before rates go up. Buy. Buy. Buy. And what did I do? We had a podcast about that, but that’s the maximum financial risk.

Shawn:

And everybody wants in, and it can go nowhere but up from here. These successful investors recognize that this is the most potential financial risk right now because everybody thinks it’s going nowhere but up.

Bob:

Bring that chart back in and just take a look at this chart. You notice where I think we’ve passed the fear part.

Shawn:

Okay. Yes.

Bob:

Yes. The desperation. What should I do? We’re starting to get to the panic and I give up part. I don’t know if we’re to the hopelessness part yet.

Shawn:

It doesn’t seem like we’re at the very bottom of it yet. So, I would definitely say somewhere around that “panic” to “I give up”, maybe.

Bob:

So, it’s already on sale. Remember, you should buy when things are on sale, but for some reason, no one wants to do this in the stock market.

Shawn:

Well, especially for people who the most common thing about them, of course, is people have some sort of retirement plan at work. Maybe a 401k, it’s most common. I mean, I’ve already had multiple clients asking, well, hey, should we not make those deposits anymore? I’ve told every single one of them, absolutely not. If anything, if you can contribute more right now in your cash flow, do it. I mean, that means every paycheck you’re buying that much more on sale and you know what, Hey, even if it goes down another 10 to 20%, keep buying. You’re just getting more. Because unless you’re retiring in the next couple years, it doesn’t really matter if it goes down more.

Bob:

So let’s look because what does the chart tell us? And I’m telling you, this chart is a great chart. I followed it for years. Successful investors recognize this is the maximum financial opportunity. Now, maybe we haven’t gotten to that bottom yet, but you know what? No one can predict when the absolute bottom is.

Shawn:

You can only predict the absolute bottom when you’re 6 to 12 months past it.

Bob:

That’s a good way of seeing it.

Shawn:

Kind of like right now, how we say well, who would’ve predicted that for year to date, we’d be down the way we are? Well, it’s easy to look back now and see when in December, January that that happened. That was the maximum height, but you can’t know a hundred percent when you’re in it.

Bob:

So what’s happening right now? See, we talked about this the other day. We talked about this, and just don’t break it, because that would hurt.

Shawn:

I’m putting a lot of trust in you right now, Bob.

Bob:

But that’s where the economy was about six to eight months ago. Nine months ago. We had stretched it so far.

Shawn:

You’re getting that bull market.

Bob:

I’m not gonna go any farther, because I know that that could break , but that’s how far we had gotten. Now we we’ve gotten back probably about that far. And we could go as much as that far. But let me tell you, I’m not gonna break this. Pull against me. If we kept pulling – I don’t wanna go any farther than that. If we kept pulling any farther than that, what would happen to that rubber band?

Shawn:

Snap.

Bob:

It’d snap. So bear markets, like we talked about the benefits of bear markets a couple weeks ago, there are benefits to bear markets. The economy was getting stretched. It was way, way out there, and it needed to move back. So rubber bands, they’re like checks and balances. And that’s what we need in these markets.

Shawn:

Just like any market, and not just the stock market, but markets in general, they all go through cycles. There are periods of growth and there are periods of decline. That’s just a natural part of it. Like Solomon says in Ecclesiastes, there’s a time for everything. There’s a time to sew. There’s a time to reap. Well, you can’t just always reap. There’s a time where you gotta sew. If farmers, all they did was reap, well, they’d have maybe a good crop one year and then nothing but weeds the next year.

Bob:

I can see you’re having fun with that rubber band.

Shawn:

I am. Well, it just made me think, too, when you have a bull market and then you kind have a correction. Not that big, but then when you have a really big bull market…

Bob:

Yeah. That’s real estate right now.

Shawn:

It’s got more snap back, you know what I mean? Like, it gets under tension. I’m aiming this right at you.

Bob:

yeah.

Shawn:

It gets under tension and then that’s why usually, I mean, if you look back when you have a huge bull market rally, you usually have a more severe bear market bear market. Again, I use the rubber band as an example. You get that tension, and it’s gotta kind of reset almost to an extent.

Bob:

And remember, stovkck markets move quickly. They reset fast for real estate. It moves slower because it’s not appraised every single day. So, I hope that helps you some with the rollercoasters, emotions, and rubber bands theory that we talked about today. And I don’t believe it’s theory. I think it’s real.

Shawn:

Well, just look at the charts. Remember, you can’t predict when your bottom or your top is in the markets, unless you look back 6 to 12 months or further, then it’s really to see. So look back. There’s a lot of websites. You can look at it for free, but just look at the markets. If you don’t believe us, count how many times you’ve seen it go up and you go down, then you go up and then go down.

Bob:

So as always, we’re here for you. If you have any questions during business hours, give us a call at (830) 609-6986. You can text to that number as well, and we’re here to help educate you and get you through these crazy times.

Shawn:

God bless.

[CONCLUSION]

That’s all for now.

We invite you to listen to all of our past episodes covering many financial topics from a Christian Perspective. To make sure you don’t miss any of Bob’s upcoming episodes you can subscribe to Christian Financial Perspectives on iTunes, Google Play Music, Spotify, or Stitcher. To learn more about integrating your faith with your finances, visit ciswealth.com or call 830-609-6986.

[DISCLOSURES]

Investment advisory services offered through Christian Investment Advisors Inc dba Christian Financial Advisors, a registered investment advisor registered with the SEC. Registration as an investment advisor does not imply a certain level of skill or training. Comments from today’s show are for informational purposes only and not to be considered investment advice or recommendations to buy or sell any company that may have been mentioned or discussed. The opinions expressed are solely those of the hosts, Bob Barber and Shawn Peters, and their guests. Bob and Shawn do not provide tax advice and encourage you to seek guidance from a tax professional. While Christian Financial Advisors believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability.