Click below to listen to Episode 141 – Should I Still Wait To Build Or Buy A Home

Subscribe: Apple Podcasts | Google Podcasts | Spotify | Amazon Music | Stitcher | RSS | More

Should I Still Wait To Build Or Buy A Home

We’re back to the topic of “building or buying a house” that we covered last year around this time, but we are coming at it from today’s ever-changing housing market. Buying or building a home is something that probably 100% of those listening have done, thought of, or plan to do. However, in today’s economy and right at this moment, is this something that should even be considered?

Should you STILL wait to build or buy a home? Bob and Shawn delve into the math of this topic with statistics on financing percentages, past trends, and exceptions to the rule. So, if you were thinking about building or buying a house in the near future, this episode is definitely for you!

HOSTED BY: Bob Barber, CWS®, CKA®

CO-HOST: Shawn Peters

Podcast Charts

Mentioned In This Episode

Want to ask a question about your specific situation? Schedule a complimentary 15 minute phone call.

EPISODE TRANSCRIPT

Intro:

Welcome to Christian Financial Perspectives, where you’re invited to gain insight, wisdom, and knowledge about how Christians integrate their faith, life, and finances with the biblical worldview. Here’s your Christian Financial Advisor’s host, Bob Barber and his co-host, Shawn Peters.

Shawn:

Welcome to another episode of Christian Financial Perspectives. We’re so glad you joined us. If you do like videos on all kinds of financial topics, but from a Christian perspective, we encourage you to smash that subscribe button and give this video a like. Today we’re going to be covering a topic that last January we did touch on. This is kind of a revisit or 2.0 part two on, “Should You Still Wait to Build or Buy a Home Today?” Now, I do want to give just a quick heads up. It is Cedar season and it’s hurting me a little bad right now. For those not in central Texas, it just means bunch of bad trees trying to hurt people. I will do my best to edit things out if I do cough or anything.

Bob:

Hey, I’m going to help you, Shawn. I’m going to be right there with you. Like I said, last year, it was this very week that we did a program on should you wait to buy or build a home today, and a year ago, we warned you not to do that. Today’s program is going to be called, “Should You Still Wait to Build or Buy a Home.” I think it’s good to go back and look at some of the things we covered last year, Shawn, and the many reasons that last year you should wait. Some of those reasons were, we were coming off of an eight to 10 trillion.. eight to 10 trillion. It’s hard for me to

Shawn:

Trillion, drillion, quadriIlion, I mean whatever. It’s all about the same. It’s a lot.

Bob:

Eight to $10 trillion of financial stimulus from the government that put the economy in hyper mode. That was in 20 and 21. To think about that in context, that was $24,000 on average for every man, woman, and child in the United States. That’s throwing a lot of money into the economy and it artificially stimulated the economy and real estate beyond anything that I’ve ever seen in my life. Then you add on top of that artificially low interest rates for mortgages, and that was coming to an end. It was for the first two or three months of last year, but now that’s ended completely. The Fed, also we warned last year, and they’ve done it now. They were tapering off the buying of $130 to $150 billion of mortgage bonds per month that they were buying, and that created massive liquidity in the mortgage markets. It really made the mortgage markets very loose. A lot of it was easy to find money.

Shawn:

They were pulling back on doing that.

Bob:

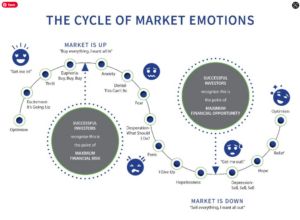

This massive stimulus again, created artificially high real estate prices, and not last but least, we talked about the emotions buying chart last year. It was showing across the board, “sell, sell, sell” not buy. It was not a time.

Shawn:

The indicator was sell, not a buy.

Bob:

We’ll take a look at that emotions chart. We can put that up on the screen for you and you can see that. We’re kind of getting at a point now to where, in the next six months to maybe a year. It maybe time to buy, but not yet. Not yet. You should still wait.

Shawn:

To answer the question of, “Should you still wait to buy a home in 2023?” Yes. In almost all cases, except a few. Obviously we keep that in mind even where we live here in New Braunfels. There are definitely some pockets. These areas where the home isn’t on the market for even 30 days. I mean, it’s gone quick.

Bob:

But that’s an anomaly.

Shawn:

That’s an anomaly. So keep that in mind. Just because you know of a small area or you know of a home that sell really quick. What we’re talking about here is the market as a whole.

Bob:

Not those unique situations. Shawn, the purchasing power that buyers had; here’s the reason number one. We’re going to go through four or five reasons. Number one why you should wait. The purchasing power that buyers had in 2020, 2021, and half of last year in 2022 is gone. I mean that purchasing power and the national. I say that because the National Association of Realtors estimates that 87% of all home buyers use a mortgage loan to buy a home. You’ve taken out 87% of the market. The purchasing power has been cut dramatically. Here’s an example of that. A year ago, someone that wanted to go buy a $750,000 house could buy that with a $3,000 a month mortgage payment. That’s pretty high, but still. If you wanted to buy that at today’s rates, now that $3,000, mortgage payment will only finance 450,000. That’s a

Shawn:

$300,000 drop.

Bob:

A $300,000 drop in purchasing power In just one year. Now, that’s kind of the higher end of the market, but let’s get to the area that most people were in. A year ago, a $2,000 mortgage payment could finance a $450,000 home. Today, that’s a $300,000 home. The purchasing power has gone down by $150,000 for the average person that’s a lot for that to drop.

Shawn:

Which makes sense. because most people, when they’re looking at buying a home, they’re looking at, how much can I afford per month? Well, for most people, how much they can afford per month didn’t really change. Which means the price that they can afford, the ultimate price, has to go down. That’s crazy to think that from 450 to 300,000.

Bob:

Prices of homes have to drop dramatically, Shawn, to compensate for the rise in interest rates over the last year. Remember what we said last year when we made this program.

Shawn:

It’s just math.

Bob:

It’s just math. I think it will happen. It’s happening a little slower now because so many people bought homes in the last couple years at low interest rates. The turnover rate’s going to be slower because they don’t, they realize if they sell their home, they can’t get that 3% interest rate anymore. We are going to see a major drop in that, especially for the home builders that just produce and produce and produce. If you’re thinking that rates are going lower or returning back to where they were, you really need to think again. Look at this chart that we’re putting up on the screen.

Shawn:

Now Bob, especially for those who are listening as well, what exactly is this chart showing us?

Bob:

This chart is showing us the Fed funds rate for the last 50 years. For the last 50 years you can see the “means”. The dotted line that you see in the middle there. That’s the “means”. That’s where the average is.

Shawn:

The average, right.

Bob:

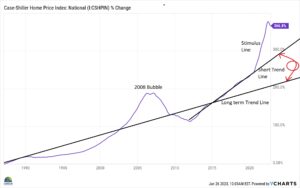

You can see right now, all we’re doing is returning to the means. We make our program, just so you know, we usually make them about a week in advance. As this comes out, we’re right there at a quarter percent increase that the Feds about to do. That means they’ve returned to the “means”. You can see the rates were kind of artificially low since 2010, 2011. We’re going to point out a trend line here in just a minute that shows how we’ve come off both the trend line from 2010, 12, 13, right in there, and there’s the long term trend line. That’s the Case-Schiller Price Index. That goes way, way back. The second reason to wait is prices have got to get back to those trend lines. We’re going to look at that now, and I’m going to explain this to you. This is the Case-Schiller Price Index nationally of home prices. Going all the way back. You can see here to about 1985.

Shawn:

Yeah, 85.

Bob:

Right, during that time. You can see the black line on here, iff you look at this chart. Those of you that are listening to the podcast, I would encourage you to really go to YouTube and pull this video up. You need to see this chart and that other chart on the interest rate.

Shawn:

We can describe it though. The long term trend line, like Bob said, going back from about 1985. Right now, we should be at around, a 200% increase from from 1985. Whereas the more short term trend line, which this was starting, what would you say Bob, it’s about 2012 maybe?

Bob:

Yeah, about 2012, then you can see that cross right here on the line at about 2015.

Shawn:

From around 2012, so this was after the 2008 bubble and things had dropped quite a bit, and they were starting to recover. From there all the way until around 2020, we’d been on a pretty consistent, more short term trend line, and according to that one, we would be at about 275%. Again, compared with 1985.

Bob:

This is up 366%. It’s huge, and you’ll see I pointed out the 2008 bubble. How it got back down to the trend line. Then there’s a long term trend line. Then you see the stimulus line. That’s all the stimulus.

Shawn:

That’s where we are right now.

Bob:

You’ll see my little red, arrows I have in there with a circle. That’s where I feel that the prices are going to end up being right in between the short term and the long term trend line.

Shawn:

Kind of a best case, worst case scenario. Where best case scenario maybe we only really come back to around where we should be according to the short term trend line. Then your worst case scenario, if you’re looking at selling your home, I guess. Your worst case scenario would be coming all the way back to our long term trendline.

Bob:

That we’re way away from that. That would also be considered the “means”. Shawn, everything in my 38 years of experience always returns back to the “means”. The trend line. Like the interest rates are doing right now. This chart is a very compelling chart. So the third reason…

Shawn:

Home prices are unaffordable.

Bob:

They haven’t dropped yet and we’ve had a rise in interest rates, and quite frankly, the home prices are just now unaffordable to people.

Shawn:

Yeah.

Bob:

Even if interest rates would’ve stayed low, they were getting unaffordable.

Shawn:

They were getting out of hand, but when you’ve got a lot of these homes that the prices haven’t dropped yet, they haven’t come back to reality, and interest rates are so high. It’s like that person we were talking about the $2,000 a month mortgage payment. Well, who’s going to be able to buy a $450,000 home on a $2,000 a month mortgage payment? They can’t.

Bob:

Yeah, they can’t.

Shawn:

Most of the houses haven’t even come back close to the $300,000 in that kind of a scenario.

Bob:

Shawn, this is just mathematics again. If anybody says, “Y’all are crazy.” By the way, last year, there were the exceptions to the rule, but the rule was most of the realtors said, “This is not going to happen.” This is mathematics all right. You can deny mathematics only so long. One plus one equals two and two, and two is four, and so forth. You can’t deny it. You can say that one plus one doesn’t equal two, but it does.

Shawn:

What was the thing I think I’ve heard you say before? It’s liars figure, but figures don’t lie. I mean it’s math.

Bob:

The exception to the rule, though, there is an exception to the rule about possibly buying that house now. That would be if the home is in a unique situation, a unique property with limited availability. Some examples of that would be waterfront homes. Like here in New Braunfels, there’s not any left. When one comes on the market, that’s an anomaly. I mean, that doesn’t happen very often. When they do, it’s going to show up.

Shawn:

It doesn’t mean the prices won’t drop some because of interest rates. However, those kinds of places, if it’s a waterfront home on the river, lake, oceanfront where there aren’t any more spaces to build on that water. Well then those are going to hold their value better. Even those homes will see a decline because it’s just math.

Bob:

An an older home like we have where you live. You are in a area where they’re older homes, but they have the larger lots and those are very sought after.

Shawn:

They got the big trees. Plus we’re even more so now in the, in the middle of town.

Bob:

A home with some acreage. Homes directly on a golf course. I’ve been looking. We go to Rockport where we have a little condo on a golf course. We’ve been looking for a home on a golf course forever. When they come up, they just go fast. There are some that are way overpriced that are not going, but I know the price range down there. There’s a certain price range. Home with a unique view. We have some of those here in our own town.

Shawn:

I would think for a good example on that is a home where the area that they have a nice view of is maybe they’re overlooking some sort of park, or something where there’s not going to be someone building on it later. I know right over where we live down the hill a little further, there’s a nice area that for a long time has had a great view. Then all of a sudden new subdivisions going in, and now they have a view of other people’s homes.

Bob:

Oh no.

Shawn:

A really unique custom built home, or maybe a home that’s just in a really good location with limited building space. Maybe from zoning issues or things like that.

Bob:

Shawn, we just described in those five or six examples, that’s not the norm.

Shawn:

No, it’s not

Bob:

That’s not 80 to 85%. The old 80 20 rule; that’s not 80% of the homes. If you’re looking to buy or build a normal type track home where every sixth or seventh home on the block is the same. Except they do a reverse image, or they do the paint color a little bit different with a slight variation, or on a lot that can be easily reproduced a few blocks away. Then we’re saying to “wait, wait, wait, wait.” Those builders are starting to really drop the prices and they have a lot more to go.

Shawn:

Just to be clear too, we’re not saying there’s anything wrong with those homes.

Bob:

Not at All.

Shawn:

For most people, that’s what people buy.

Bob:

That’s what they can afford.

Shawn:

If those are the kinds of neighborhoods you’re looking at buying in, wait. Not only are those going to be the most affected, but part of the reason why they’re going to be the most affected is because, those are the types of builders that will get more desperate. They’ve got to move their product They’ve got to get that off their inventory.

Bob:

That brings us down to really, we’re getting to the conclusion of the program. We’ve given many good reasons, I believe, why you should wait. The timing is so important. You really want to be wise and cautious right now, and not get in a hurry. Unless it fits possibly that unique situation that is a far and few between. Those main points again; prices have to drop, it’s just math and 87% of home buyers borrow to buy, there’s no more Fed free candy, there’s no more stimulus checks coming to everyone, everything has to return back to the means, and interest rates, as we showed, are not returning to the long-term average historical levels.

Shawn:

No, they are. That’s really what what we’re seeing happening. Is that the Fed is, if anything, they’re kind of just getting to the average.

Bob:

Why did I say that? Yeah, I meant they’re not going back to the level that they were.

Shawn:

The point with that is, don’t expect anytime soon to all of a sudden get back to where the Fed fed rate is 0% to 1%. That’s not going to happen anytime soon.

Bob:

We hope we’ve given you a lot of good information today on, “Should you still wait to build or buy a home?” We’re recommending continue to wait. If you want to give us a call to talk about this, you can call us at (830) 609-6986, or even text us at that number. Or go to christianfinancialadvisors.com. Anything you want to share before we get off today?

Shawn:

No, I think we covered it. If you’re the one in five people watching or listening to this that’s buying some sort of unique home, then I guess this doesn’t apply as much. For the other four out of five people, wait to buy the home, or wait to build that home right now.

Bob:

Thank you.

Shawn:

Thanks for joining us and God bless.

Outro:

We invite you to listen to all of our past episodes, covering many financial topics from a Christian perspective. To make sure you don’t miss any of Bob’s upcoming episodes. You can subscribe to Christian Financial Perspectives on iTunes, Google Podcasts, Spotify, Stitcher, or Amazon Music to learn more about integrating your faith with your finances. Visit Christianfinancialadvisors.com or call (830) 609-6986.

Disclosure:

Investment advisory services offered through Christian Investment Advisors, Inc DBA Christian Financial Advisors also known as Christian Financial Advisors Management Group, a registered investment advisor. Comments from today’s show for informational purposes only, and not to be considered investment advice or recommendations to buy or sell any company that may have been mentioned or discussed. The opinions expressed are solely those of the host Bob Barber and his guests. Bob does not provide tax advice and encourages you to seek guidance from a tax professional. While Christian Investment Advisors believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability.